Will the World Change Forever? A Look at What’s Ahead.

The tragedy and challenges of the current moment aside, it’s a fascinating period. Are we on the edge of a major paradigm shift? Will things return to normal? Is it the end of the world as we knew it over? A look through the headlines and the majority of conversations taking place suggest dire changes. Many also include exciting ideas and innovations—though many of these seem extremely impractical or unlikely to reach adoption due to unpleasant side effects.

As a student of history and human behavior, travel blogger, adtech professional, and lazy futurist, I thought it would be an interesting exercise to scratchpad a few thoughts to spark discussion and to serve as a point of reference for my future self. In this post I’ll run through a mostly high level sprint between key topics while sprinkling in the periodic deep dive. My goal is to provide you with an alternate interpretation or additional food for thought/context for key talking points I currently see taking place which I disagree with or believe are being incorrectly framed. The majority takes a US/EU centric look at the topics and issues, and pulls partially from my position with a foot in both worlds.

The timing of this crisis matters

For those keeping a close eye on the global economy, we were already well and truly on our way into a recession in the opening days of 2020. All the warning bells were going off, the markets were already starting to slow, and the various artificial stimuli that had been used to prop things up over the previous three years had started to flag.

While it’s impossible to know for sure, all indicators were that we’d be in a moderate to severe recession by the end of 2020 or start of 2021. If we look back to 2008 and the great recession, various bailout packages would have been delayed, the general spending narrative and partisan divides would have been polarized due to it being an election year in the US and any aid packages would have been relatively small, reduced in efficacy, and tagged to a host of different pre-requisites that would have dampened their impact.

There’s never a good time to be struck by a pandemic. There’s also no question that accurate and early reporting out of China, a more intelligent global response, and a semblance of competent leadership out of the US and UK early on would have led to drastically better outcomes. But, if we accept that for what it is, I’m actually thankful that the crisis struck when it did. A year later would have amplified the disaster and found the world even less prepared to respond.

I say this because there is a critical difference in how we respond to a health crisis vs. an economic crisis. Pressing pause on the global economy, shutting down borders, closing shops, transitioning workforces home, and the related steps required to blunt the impact of the virus have a profound impact on people’s lives and financial situations. But, that has also been accompanied by a level of assistance, pro-active action, and a series of bailout packages that go far, far, far beyond anything imaginable in even the worst purely economic adjustment.

Instead of a deep scratch turning into a festering wound, followed by infection, and a long drawn-out recovery, we’ve immediately turned our attention to the wound, lanced the infection, treated it aggressively with antibiotics and are now attempting to chart a path towards recovery.

Again, this is in no way to say that the COVID-19 crisis hasn’t needed significantly more aid than a major recession. But it is to say, that many of the core underlying pain points for the average citizenry in a severe economic crash are also being addressed in part by the response to COVID-19.

Those who believe we were in for blue skies and green pastures indefinitely over the coming 5 years will no doubt fundamentally disagree. But, for those who were already bracing for recession— there’s some cause to be hopeful that we’ll lose fewer years, be able to bounce back more rapidly, and that the level of economic devastation will be blunted with an accelerated return to growth.

Having said that, do I believe we have reached the bottom yet? No. I don’t. Especially not when it comes to the public markets which continue to remain artificially propped up. That said, with a lack of alternate safe harbors for money— I expect the US markets will continue to perform better than they should. Though I anticipate there’s still at least one more hard adjustment needed to bring Wall Street into alignment with Main Street.

The big question—what’s our path to recovery?

Looking to history, human behavior, adaptability, and the psychology of our species, when it comes to risk-taking behavior, I’m generally equal part optimistic and alarmed. I am quite confident that we will see a majority of day-to-day activities return to a semblance of normal across the globe by mid-July. The more localized the activity or business, the more rapid the return to normalcy with things like trans-continental travel the slowest to recover. However, I expect that even these are operating in a recognizable fashion by September at the latest. Vaccines and cheap rapid-testing tools will play a role in this, with cheap rapid-testing kits getting rolled out by the start of Q3. When I look at many of the big assumptions and claims being made about what things will look like from September onward, I can’t help but feel most a grossly off base.

- Is remote work the new norm?

- Is distance learning the new norm?

- Is global travel and the travel industry dead as we knew it?

- Are business trips a thing of the past?

- Are in-person restaurants and dining or shopping dead?

- Are small restaurants dead?

- Will the workplace, restaurant, or transit vehicle of tomorrow look significantly different than today?

Read the stories and speculation floating around and you’ll assume most of these are not only probable but essentially unavoidable. I’d argue the reality is much different and the answer to each is actually a resounding “No”. More on that in the following sections including a look at the financial markets with three potential scenarios included at the end.

As you read through, keep in mind the broader context and think of each of these as moving pieces in play simultaneously. Step back often, and consider how each also has a knock on effect (or dependency) on the others.

An accelerated path to a vaccine

Current discussion revolves around if a vaccine is ready and when. There are extremely valid reasons that all guidance points to 2021 at the earliest. I’m not a scientist. It’s a topic where we should defer to the scientists and not use anything before it’s tested and approved. However, I strongly believe that we have a vaccine, or novel but effective treatments ready for (at the very least provisional/targeted) use by October.

There are a few reasons for this. Many health organizations will view it as essential to get added protections in place in preparation for a resurgence of the virus in winter months. From a timing standpoint, researchers are not, as I understand it, starting from ground zero with the virus due to research and vaccine initiatives previously launched to fight earlier SARS/COVID viruses. From a resource standpoint, the depth and breadth of research being invested is staggering. I say depth AND breadth, because the wide range of different nationalities, backgrounds, and cultural approaches should foster a wider range of research and more paths to a solution. Additionally, recent breakthroughs in advanced imaging, modeling, editing, and advanced AI’s should further accelerate the candidate, testing, and vetting stages. Due to urgency, key processes are being fast-tracked and expedited. On a grimmer note, the scope and origin of this virus as well as potential impact also leads me to suspect that some of the nation state actors involved in pushing and testing vaccine candidates will accelerate testing despite potential risks to human health, sidestepping potential patient protections we’d see in the US. On a more positive note, the aggressive testing of existing approved medicines and treatments also seems to show promise. Here, again, advanced modeling is, as I understand it, speeding up the process. If we “get lucky” and a silver bullet treatment can be found that repurposes existing medication— the path to fast tracking its use is a given.

All of these factors suggest to me, that we’ll have several candidates ready/almost ready by October. At the very least, some of these might be fast tracked for use among high risk populations (the elderly / etc.) even if not more widely approved.

(A good listen here: https://www.wsj.com/podcasts/wsj-the-future-of-everything/covid-19-and-ai-tracking-a-virus-finding-a-treatment/f064ac83-c202-40f9-8259-426780b36f2c and reference a freshly reported sample of a vaccine starting trials with potential emergency usage in September here: https://www.nytimes.com/2020/05/05/health/pfizer-vaccine-coronavirus.html)

Societal Impact

Is remote work the new norm?

A slice of my academic work in 2007 and 2013 focused on the potential of using virtual worlds for distance learning. The big concern that always came up, was that digital would supplant real-world interaction. It’s an OLD fear. But, just as the holodecks in Star Trek didn’t replace the need for human reaction, remote technologies will not pose a legitimate threat to in-person environments any time soon. To subvert and replace existing in-person environments, the technology has to either A) be able to provide an otherwise indistinguishable experience or B) provide a suitable value add, that makes it situationally superior (or tolerable) to a similar in-person experience.

We won’t see A) happen in the next 20 years. As for B), in the short term, not catching COVID and dying is a significant advantage. However, offices, like academic campuses, serve a wealth of different purposes that go far beyond simply making sure you’re present and working. The rise of co-working spaces is, in part, the very illustration of this. As more flexible work schedules have evolved, and the web has enabled more remote work, you’ve seen demand for office-like spaces explode.

The reality is that remote work is great for a small subset of personalities and job roles, good for a wider cross-section of personality types, industries, and job roles, and terrible for a much wider cross-section of personality types, life situations, industries, and job roles.

I work in a heavily decentralized organization, as part of a decentralized team spread across five countries. Before COVID struck, I worked on average two days a week from home and in previous years have done 2-week remote stints from other countries. The pivot to remote work during the crisis was not only not problematic, but completely convenient. But, even in a team familiar with remote work, the impact of prolonged remote work is palpable. There’s a reduced exposure to information, social bonding, creative pacing, and a degradation of space-associated mindspace and focus which comes with having a set environment to work in and immediate personal communication.

Certain things are better done in certain environments. The key is a blend, and that blend is also highly individual and dependant on your team, on your personality, on your work ethic, and on the tasks you need to accomplish.

So, is the office dead and remote work the new norm? The answer is still a strong no— and the evidence spans across the ebb and flow in the debate surrounding remote work over the past 20 years. However, hopefully we see some organizations adopt a more lenient approach to remote work and an increase in receptiveness to hybrid remote/office approaches. Just as forcing employees to come in to the office and desk-warm strict hours backfires, attempting to force remote work would be equally disastrous to retention, worker satisfaction, and effectiveness.

Is distance learning the new norm?

The existing distance learning offerings are fucking terrible. Not only is this not the future of education, it’s symptomatic of a complete misunderstanding of what education is and should be. People regularly confuse the power and benefit of technologically empowered and self-directed, or even digitally guided, learning with robust distance learning as a whole. The fact that I can teach myself something through youtube videos, or that I’ll spend hours watching and listening to podcasts or edge.org videos is vastly different than a guided and well-tailored educational experience that is social, co-present, and provides proper spatial context.

All of the elements I discussed when talking about the future of remote work, also apply to distance learning. But, with distance learning it’s even more dramatic. The power and benefit of social immersion, socialization, and constant verbal and non-verbal feedback are every bit as important as basic coursework. Similarly, the accidental exposure to information which takes place via in-person and facilitated learning experiences is profoundly valuable.

While some of these challenges will be mitigated in the next few years as facial tracking helps monitor understanding and attention, as virtual spaces create more relatable learning environments, etc., we’re still a long way away from that. In the same way driving an actual car at speed is vastly different than sitting behind a PC screen with a keyboard and mouse, distance learning and in-person education are vastly different entities.

There is a place for distance learning, and it can be profoundly valuable for scaling knowledge sharing sessions or enhancing the quality of an educational environment when in-personal limitations are significant or prohibitive. But, make no mistake, it remains an inferior option and the majority of people advocating for the replacement of in-personal education are doing so for financial, not educational gain.

Is global travel and the travel industry dead as we knew it?

The folks who were at war with the airline industry before COVID struck, have been quick to try and pivot that momentum into a narrative about the collapse of global travel and freedom of movement as we know it. Other groups have pointed to the spread of the pandemic and similarly put forth arguments that we have to lock down global travel … or else. The reality is, the ease and pace at which these threats spread is of concern, and added mitigation, early detection, and rapid reaction tools need to be put in place. However, the plague is as old as humanity and commerce. Walls create far more problems than they solve, and we live in a world that has unstoppable momentum towards enhanced connectivity. It won’t matter if it’s hydrogen powered rockets, hyperloop tunnels, or maglev trains. But, the truth of it is, it’ll very likely continue to be all the existing tools we have with minimal changes or updates.

The big question in the short term, isn’t if there’s interest, desire, and willingness to resume global travel and for the travel industry to jump back. There is. It’s what the potential limitations, economic factors, and points of inconvenience will be.

Most of us cannot afford, and will not dedicate the time to visit places that maintain a 14-day quarantine on arrival and return. Outside of closed borders, I see this as one of the most prohibitive blockers. Things like rapid-testing, better monitoring, and added safety and security precautions during transit will mitigate the need for these quarantine periods. However, it’s up in the air on if they last in most locations past the end of May / June or into August.

You’re already seeing countries showing interest in re-opening borders. While it may take decidedly longer for full freedom of movement to be restored, you’ll see it happen by end of year in all but a tiny subset of countries. Some may accelerate that process with cooperative zones such as the Australia/New Zealander travel bubble currently being discussed (https://edition.cnn.com/travel/article/new-zealand-australia-travel-bubble-intl-hnk/index.html). Other natural ones would be include the Nordic countries, later expanded to the Eurozone in incremental steps. This isn’t unlike steps China has taken to open up country-sized provinces internally. Still, even these bubbles will be, I suspect, quite short lived. Though it will be interesting to see if regions that have shown a strict adherence to coordinated mitigation efforts such as the Eurozone, are willing to open up to those that have not—such as the UK and US—any time soon. There are some grumblings out of the US that borders may not open to international flights in 2020. (https://www.ft.com/content/6717f2c1-d65f-45bd-88d6-654a09c746ad?fbclid=IwAR0kDEO0Z7GJ54eivcNvkIQNXFx7mcB4YuCaDScGBb7XoWz1zl5nB_FsfK0&fbclid=IwAR1qCQCP7_8S9Z7_bdGTA5QX6vVGnCWZGftXTdlT-gb5ayr8I3DGk3jua6M) While very unlikely, if the Trump team gives in to Stephen Miller and his block/tries to focus the Presidential campaign along xenophobic/nationalist lines—they may well focus on keeping borders closed to support the narrative. I suspect that given his tendency to focus on his own hospitality possessions and business pressures from others in his cabinet, that this won’t be the case and will instead be selective bluster leading up to an accelerated opening of the US shortly thereafter while using it to try and extort trade or other agreements.

Meanwhile, airlines have already started to hint at the path forward. While many early speculative posts winged on and on about how this would mean the death of budget air travel, how seats would have to be removed, or cabins completely re-designed, what we will see will likely be minimally different.

This brilliant video from Wizz Air illustrates the direction I think we’ll go, and what the flight process will look like by the end of June, or July at latest: https://youtu.be/2mVFOEaDrxI

I anticipate you also see initiatives similar to what Emirates Airline deployed early in the crisis where they offered rapid COVID testing before boarding. A few added precautions to distance people better on planes, enhanced hygiene, and a mild re-design of the average airport and things will largely return to normal.

I’m only minimally more concerned about a flight with proper precautions taken, than I am the metro I ride daily to work, city transit buses, regional trains, or buses. Most of which have far higher usage/contact/and risk of contamination anyhow. Beyond that, once bars and restaurants re-open, the actual risk in comparison to a flight is negligible.

You also have a large subset of travelers that are generally cautious but not deterred by moderate to low viral threats. For example, somewhere around 290 million tourists visited Asian-Pacific countries last year, despite previous pandemics in the region, risk of malaria, dengue, etc. (https://reports.weforum.org/travel-and-tourism-competitiveness-report-2019/regional-profiles/asia/)

The bigger risk to airlines will be economic woes. Cheap fuel may help them, as might some bailouts, but many airlines had over-extended before the crises (dropping massive airline orders at $200-300M a pop was a bit careless to begin with). We’ll continue to see airlines fail, merge, and re-emerge, but I expect flying will continue in the pre-crisis direction of being air-based, long-distance buses. My primary hope is that this crisis forces airlines to retire older and much less efficient aircraft, and perhaps pushes environmental investments that move air travel towards more environmentally-friendly builds and propulsion methods.

Past September/October—this is a supply/demand issue, and a question of what the recession does to people’s vacation $$$. Not a COVID-19 issue.

As far as the opening of borders? Some may lag behind. But again, markets like Greece, Italy, Thailand, Iceland and Spain whose economies are heavily driven by tourism will be open for business fairly quickly.

Some businesses like amusement parks and cruise ships may also suffer a brief hiccup and overall brand damage to non-boutique cruise ships is probably significant but, even they are likely to recover within 24 months. Hopefully, this will all help to clean the industry up which has appalling business practices, hygiene standards, and safety standards. As evidence of this, in the time I’ve taken to write this blog post, Carnival has come out and announced they’d resume operations in August with 8 ships immediately after the CDC’s no sail order expires (source: https://www.theguardian.com/environment/2020/may/04/carnival-cruise-line-coronavirus-resume-operations).

Are business trips a thing of the past?

Absolutely not. We will see a reduction in business travel, due to the recession/depression. But, again, that’s what we’d have seen with any economic slowdown. The value and business case for business travel and business trips remains extremely high. Anyone saying otherwise, is effectively implying that chatting on tinder with a date is the same as a cozy night with some wine, dinner, and a movie in bed.

In the short term will non-essential travel be slow to recover? Yes. Will that start to ease up within the next few months? Somewhat. It will depend very heavily on barriers imposed such as quarantine, business needs, and budgets. I suspect in most cases business travel wont resume until the middle of Q3 when organizations have a better grasp on their YTD financial situation and start to ramp up and execute business that got pushed in Q1 and Q2.

You can do some things through Zoom, Teams, and remotely but … they have their limitations.

Are in-person restaurants and dining dead?

I can’t count the number of articles I’ve seen that say something like this excerpt from a recent FT piece,

“Many small restaurants and corner stores will never reopen because “cloud kitchens” or the 24-hour pharmacy will have taken their places. Gym operators may find that clients accustomed to exercising at home may not attend as frequently.” https://www.ft.com/content/bc7cbed2-8bae-11ea-a109-483c62d17528?fbclid=IwAR3hfWXJ2SZKPru-hS1Tm32so0FXo8BTj01eM7cW0Tt2rRXsfS0gHJxbt6Y

… and each time I read it I’m shocked because it’s … well … dumb. In this case, it’s slightly more sophisticated due to the mention of Cloud Kitchens. Which is apparently the next WeWork and essentially just a coworking space for takeout restaurants. So, the logic essentially goes that because a lot of restaurants have failed due to lockdowns, and that now we’ve trained millions of people how to use takeout services like Uber Eats, Just Eat, Wolt, etc., that small restaurants are doomed.

There are so many issues with this one, I’m not sure where to dive into it. But, the preliminary one is the implication that we’re going to pivot exclusively to a takeout model which wipes out small restaurants and then presumably go to large chains for major meals. Living in Copenhagen, where there has been a recent explosion of delivery services and takeout is fairly mainstream, it’s easy to see how someone living in a major capital— particularly New York or a similarly sized/densely populated city with tech literate affluent folks—might get a bit confused. But, doing so forgets that take-out joints and delivery have been around forever. Also, looking at all the restraints this closure will wipe out and the % of unemployed folks who are out of work because of restaurant closures—it’s easy to jump to the conclusion that the whole industry is in long-term trouble.

But, this completely glosses over the highly turbulent nature of the industry. Many restaurants close during low season, or cut back on staff. In a normal year, depending on what you read, around 20-60% of restaurants fail in the first year (with smaller restaurants failing more often), and the vast majority close before their 5th birthday. There’s a reason the very first two business you ran as a kid were a lemonade stand and a cookie stand. Restaurants are by their nature something that pops up quickly, fails quickly, and pops back up just as quick.

This crisis is wiping out a lot of mom and pop shops, it is also taking down some iconic ones—here in Copenhagen we’ve already lost two Michelin star restaurants with more to follow. But, they’ll also likely re-open shortly after things re-start with a new name and re-incorporated ownership.

Takeout services also require speed/convenience and population density to make sense. Uber Eats is in 327 North American cities. That’s not just the US, but Canada and Mexico as well. In Denmark, Wolt, the Finnish company relies on swarms of bicycle delivery folks to make things work. Even when drones are prolific though, and rapid automatic delivery is more straight forward, don’t expect this to replace small restaurants. Just look to China and Vietnam etc. where the model for these services originated. You have just as many small cafes and street stands as ever.

This whole argument also completely misses the fact that delivered takeout, if it’s not pizza or Asian, tastes like shit. Soggy, over-cooked, inferior-tasting shit. Anyone who orders and eats takeout vs. eating in, is prioritizing their desire not to cook and laziness over flavor. People go for delivered takeout when they’re lazy, or when they’re feeling self-conscious about eating a meal on their own. Beyond that, the market that’s being cannibalized isn’t the small restaurant market, it’s the cook-for-yourself/go-shopping market.

All of which still misses the whole point that many visits to a restaurant are based heavily on the social aspect and flavor. Even if it’s only a take-out shop with 2 tables, I’ll still eat there, because the flavor will be better and the conversation with the owner or staff is sure to be engaging.

And one only needs to talk to a few restaurant owners, to get their opinion of delivery services. They HATE them. These services charge fees, on top of fees, and are terrible for the restaurant. On top of shelling out a ton of money for the delivery services and related fees, they also have to deal with diners rating their service and the flavor of their food based on takeout flavors and home dining.

The other element to this which gets me and where something has to change is the sheer amount of waste. The COVID lockdown here in Denmark was more open than many countries. As part of it, restaurants had to close unless they offered takeaway or delivery services. While this has been great for many restaurants and semi-homebound diners, the amount of plastic and unnecessary waste is pure insanity. We’ve gone from a society that was alarmed and having a national debate over plastic straws to fully embracing the most wasteful and disgraceful form of dining possible.

I would love to see the math on the impact, waste, and tradeoffs for a week’s worth of plastic-wrapped takeout meals, vs. in restaurant meals. I’m sure it’s tragic. The vendor providing our lunch at work currently delivers each person’s meal as 3 separate plastic trays of which 1 is semi-reusable. The whole thing is disgraceful. Once things recover a bit, I’m looking forward to a broader discussion about delivery and takeout waste. In so many ways it reminds me of all the same mistakes made in the 1960s, 1970s and 1980s with TV dinners.

Will the workplace, restaurant, or transit vehicle of tomorrow look significantly different than today?

There has been justified speculation that we might see “Post Sept 11th” levels of structural change to transit hubs, vehicles, and workplaces. While I think we’ll see some minimal modifications, I doubt we see any significant changes. I already spoke to examples of this with the travel section and Wizz Air video. I do think you may see enhanced testing in some large facilities for a set period of time, similar to metal detectors after 9/11. This might also be thermal cameras. However, in practice these will be minimal add-ons, not long-lasting changes.

In Denmark, suspended Plexiglas barriers went up quite quickly along with gameified markings on the ground for social nudging in markets, stores, etc. These were an elegant and simple solution that has been widely effective. I expect we’ll see small changes like this continue to be implemented.

I’m most curious if those barriers remain up, if they’re removed in a few months, or if they’re incorporated into shop designs moving forward. Outside of very specific use cases in high density offices such as call centers, I doubt we’ll see any significant changes pending regulations from health authorities that mandate set distances or air circulation requirements.

Any such changes seem somewhat moot though once bars and nightclubs are OK’d to re-open. It will be very interesting to see if there’s a consistency in logic and behavior between the different spaces, or there’s a cognitive dissonance and they end up being handled very differently.

What about the future of Zoom, Teams, etc.?

I anticipate that once things open back up, we’ll see usage levels at 20-30% above pre-COVID levels. I’ll be surprised if it’s much more than that. The value of these tools for facilitating communication remains largely the same as before the crisis. Reductions in travel budgets and a small bump in remote work will increase their usage over a prolonged period in many offices but, I suspect you’ll see fewer workplaces incorporate them as a new staple technology than people expect. Many of the orgs that benefit from or use these technologies now, were already using them.

However, the biggest impact of COVID will likely be building familiarity with and catapulting forward technological adoption of these technologies against laggards and pushing usage into social circles. While some small businesses may leverage Teams, Zoom, etc. in ways they didn’t previously, the wider adoption will likely be social. For most people, once in-person meetings are an option again, Zoom and related apps will start collecting dust, only to get pulled out for special occasions or long-distance socializing. Even this, has largely been possible already and widely ignored through existing platforms. It will be somewhat useful for certain types of events and distance-based communities but, will see minimal prolonged change in communities where copresence is possible.

Introverts vs. Extroverts in Lockdown

One of the other areas that is generally interesting to observe as part of the lockdown is the overall difference in navigating the lockdown between introverts and extroverts. It’s one of the only times I can think of where the world, which is widely dominated by extroverted processes and social constructs, has inverted to be dominated by introverted process and environments/protocol. To say it hasn’t been pretty or pleasant for the extroverts would be an understatement.

It’s a powerful empathy exercise and opportunity for the two groups to discuss strengths, feelings, observations, changes in productivity, expectations and mental narratives. Unfortunately so far, that has been somewhat limited. As things normalize and re-open, it will be interesting to see if the experience drives added empathy both ways and sparks new understanding, or largely ends up being overlooked.

It would also be fascinating to do a study on the role each group plays in facilitating the spread of a virus. Or, if you wanted to strip the virus side away, ideas/thoughts and a variant of node theory for the dissemination of ideas.

Watching extroverts in my social circle, and their social behaviors, time scale, and the number of social interactions they have had vs. the introverts makes me suspect that you’d see very significant differences in infection and dissemination based on personality type and the corresponding social drive.

The accelerated adoption of technologies

One of the biggest upsides out of the COVID crisis and an area of potential disruption and acceleration during the recovery is likely to be the accelerated adoption of new technology. Earlier I spoke to the mass adoption of Zoom and related technologies. From folks learning how to order food through mobile delivery apps, to grandparents learning how to conference call, to digital health consultations, or digital banking—there is no question that the crisis has pushed forward the adoption of many different technologies and processes that would otherwise have been more gradual or delayed by years. This extends to all aspects of our day-to-day lives and the tools we are using for dating and sex, to video and music consumption, financial payments, even tiktok signups and demographics—you name it, if it’s connected to the web, it got a boost.

This will prove to play an interesting role in opening up new markets to brands, entirely new avenues for engaging with their existing audiences, and disrupt traditional business models. Earlier, I was a bit hard on the FT’s article and others for their take on restaurants. But, that’s not to say I don’t fully agree that there will be a series of wider impacts across the board. Some researchers have speculated that the acceleration of mobile payments in Asia was due to the region’s more extensive exposure to the Swine Flu and Bird Flu.

I’m very curious to see how this shifts the demographics of certain tools and technologies and what it does to the connected communities and market opportunities as a result.

Quality is secondary to authenticity and presence

During my active blogging and content creation days, I set out to understand youtube and the type of content that engaged audiences. The takeaway I settled on was it needed to be content that was either informative, or invoked a visceral reaction—fear, disgust, arousal, etc.—and that was superior to polish or perfect production.

While the ideal combination is a mixture of all of the above, one of the very interesting things to come out of the whole COVID period is the pivot by TV/Media/others to the creation of “at home” content. These, despite the polish, have been widely successful—even more so than if they had created “at home studios” with superior quality (which would have been possible if not easy and practical). It’s a very interesting insight and look at narratives, timing, authenticity, and the interplay between quality content and contextual relevance vs. polish even while production levels and digital quality reaches new heights.

This becomes a powerful reminder for everyone from brands to storytellers and I believe there’s a lot to unpack. It will also be interesting to see if it opens up more opportunity for other types of content producers in the short and mid-term, or actually floods the more aspiring professional and hobbyist channels in a way that has the opposite effect.

Economic and market impact

The collapse of oil won’t be a big win for green energy…but investment might

A rather fascinating fumble by the oil markets is continuing to play out. At some level I would hope it was jumped on as an opportunity to wean the US off part of its oil addiction while nurturing a systemic shift and re-allocation of resources to accelerate the transition away from the worst types of oil production and usage. Unfortunately, there’s no indication that it will go that way.

Since the US opened up oil exports in 2015 the various pipeline disasters and attempts to open national wildlife refuges and related priceless treasures have been as frustrating as they are shortsighted. Even worse, I still worry about the incredible adverse impact of fracking and the plethora of disasters it’s accelerating from water contamination to plate motions (and if I REALLY get my conspiracy theory hat on—a fear that it’ll set off the Yosemite Supervolcano). All that aside, the current administration has shown it’s far more likely to double down on, protect, and further entrench oil interests, from its attack on the EPA, protections put in place after the deepwater horizon, and the opening of highly sensitive American national resources to exploration and private interests.

Sadly, the outcome of the geo-political fight over oil prices, production war, spats between the Saudis, US, Russia, and others will do little more than inconvenience American oil interests while undercutting alternative fuel sources and related initiatives. Cheap oil and gas isn’t going anywhere, and it’ll take some time to balance out the surplus. There’s a brilliant writeup on the geo-politics taking place behind the scenes here: https://www.bloomberg.com/opinion/articles/2020-04-29/covid-19-oil-collapse-is-geopolitical-reset-in-disguise?sref=RVYQDGpl and for anyone who wants additional background context, diving into how oil supply and related price wars are being used to apply pressure on various petrol-states is fascinating. Dimensions like the Iran-Russia-Saudi spat is as fascinating as it is complex. Also, how the low price of oil and various other geo-political posturing may set off or magnify existing humanitarian crises around the globe.

Still, I do hope that whatever additional funding package comes down the line, it will also include carveouts for green energy and related infrastructure spending. Prolonged depressed prices might also have some benefits in encouraging the shut down and discontinuation, or at least delay, additional field exploration and more expensive extraction methods. If this led to the decommissioning of some deep water rigs, and things like oil sands etc. and in its place support of those orgs investing in alternative energy sources—I’d consider it a major win.

The market still makes no sense

I started this reflection musing on how stimulus and rapid reactions to the crisis might help accelerate our recovery out of the recession. Having said that, I also still feel like the market is grossly over-valued. My suspicion is that traders are looking at the general trend of the market over the course of the bull run since 2008 and drawing a line similar to the red line I’ve added to the snapshot of the Dow Jones below. The underlying assumption being that this is roughly where we should/would be without the 1.5 trillion dollar tax cut/corporate handout Trump used to keep the markets high in 2017 if no recession were taking place.

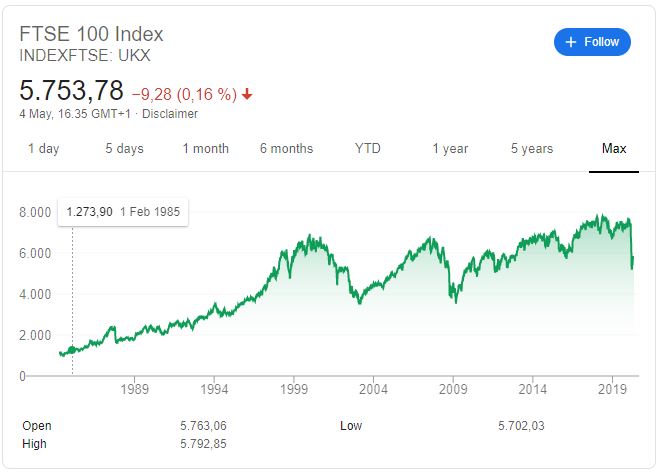

The problem with this is, that all of the other indicators in the lead-up to the COVID crisis showed we were entering a recession. This included the behavior of gold, which normally spikes during a crash where it’s used as a safe-haven, and then crashes as the recovery begins. While gold has spiked to $1,700 and is near all-time highs, it doesn’t look like the emergency re-location that normally accompanies a full crash has taken place yet. This fits a bit better with the look of the UK’s FTSE 100 which is down, has recovered slightly, and yet still hasn’t gone below 5,000. When I look at historical examples, a deep recession/depression normally results in roughly a 40-50% loss of market value at bottom. This would mean another 500-1000 points from the FTSE’s lowest point and another 2,600 below the Dow Jones lowest point at the very least, and a full 7,500 points below where it currently is.

A look at unemployment data is quite dire: 21+ million Americans in a couple of weeks out of work, and a 16% unemployment rate (potentially up to 20% once final figures come in). That’s destined to fall as lockdown ends and folks return to work and businesses re-open, but is still likely to leave a doubling or even tripling of the pre-lockdown unemployment rate. It also doesn’t take into account all the folks furloughed but retained, or wide-reaching numbers of corporate employees who have taken double digit, multi-month, or year-long wage reductions.

This is where the rapid bailouts hopefully have helped mitigate some of this shock and not only protected quite a few jobs/businesses, but will cue up a more rapid recovery.

Still, even if that’s the case, the market’s focus seems to be purely on immediate cause/effect of the COVID shock and lockdown without any wider look at the trajectory many businesses were on before the crisis. This includes high profile missteps and a fragmenting confidence in a number of the major VCs and the valuations which were floating around, oil prices, etc.

At the same time, the US also benefits from being the best worst option, among various options out there. The self-inflicted injuries resulting from Brexit have reduced the attractiveness of the UK. The Chinese markets are untrustworthy. Russian markets are similarly problematic. While Japan and Germany have their own potential challenges.

It seems to me there are three potential scenarios from here:

Scenario 1: There was and is no recession

Despite the lethargic figures coming in before COVID struck, and the world blowing past the 10-year window since the last major recession (historical cyclical trends aside), sufficient steam was let out of the economy by Brexit, Trump’s trade war with China, concerns over Trump’s election, and the small silent recession in 2014 to break the trend. In line with this, there was some economic slow-down, but rather a minimal deceleration vs. reversal or economic breaking. In which case, the adjustment and infusion of support that resulted from the COVID crisis should serve to support the building of additional economic momentum and a return to a bull market.

Scenario 2: The crash hit and we’re accelerating out of it

In this case, the 30+% drop that took place was the adjustment, which happened earlier than it otherwise would have and was cloaked/offset by COVID and the various global aid packages and support. The rapid bounce back, will now be followed by a tepid period of initial recovery which will then accelerate in 6-12 months time as the full impact of the COVID crises processes out of the global economy. Specific markets will experience a particularly delayed recovery due to their emphasis on impacted sectors such as tourism but most global economies will largely recover.

Scenario 3: The crash is still coming and is currently obscured by the COVID crisis and response

This, which I find the most likely, would follow a double-tap, two-layered market crash with the first and more shallow of the two being the Q1 market crash. That would place us in a small lull and false recovery, which will tip over into the second, deeper, adjustment in the coming 30-90 days. This would be less clear cut and the small lull extended due to confusion over how much is COVID induced, how much is the previously anticipated economic adjustment, and how much is the result of the two interacting. Here, again, the bailouts and stimulus should help mitigate some of the worst effects and serve to jump start things more rapidly while providing the economy a chance to catch its breath and start to recover. What’s missing is the hard investment in infrastructure investment, education and a re-tooling of the economy which isn’t currently included in the COVID rescue packages.

And what of inflation?

I really have no idea. While many argue “inflation is dead”, that seems highly improbable and with many of the actions in play currently, inflation seems like it is increasingly a very, very, real risk within a few years. I see this as further motivating folks to dive back into real estate, gold, or the stock market or other options that tend to float with inflation.

Other thoughts and hopes?

Will this finally be the end of neoliberalism (read here: https://www.theguardian.com/books/2016/apr/15/neoliberalism-ideology-problem-george-monbiot) and its 50-year ransacking of the American dream? I sure hope so. But, I also had hoped it was on its death bed with the collapse of the neo-conservative movement in 2006-07 but what arose was an even more predatory and detrimental version.

As an American living in Denmark, I’m also profoundly hopeful that this leads to a course correction that repairs the American medical system and pivots to a more cost-effective and beneficial model. If there was ever a time, and economic incentive to execute the pivot, this is it. Unfortunately, the current administration has moved in the opposite direction and even with a change in leadership come November, I doubt we’d see an overhaul of the healthcare system executed within the first 2 years.

I also worry that one tradeoff of our adaptability is that despite all of the pain inflicted and the loss of life, that we will not take steps to prevent future outbreaks. While I disagree that the path to doing that is closed borders or limitations on freedom of movement, I do believe that well-resourced and politically independent bodies and global cooperation are essential. Executed alongside local, regional, and governmental steps that prepare for and facilitate early detection and mitigation. With 9 billion people in the world, there are more opportunities than ever for things to go wrong. We must use innovation and think our way out of these problems; tap into the true potential of highly innovative technologies while remembering that the strongest among us are only as safe as the most vulnerable.

Final thoughts – am I hopeful?

I am. History tells me that this too shall pass, and what is to come will be better than what has been before. I’m heartbroken, but hopeful. We will travel again. We will return to something that feels and looks similar to our old normal. But, there will continue to be an unbearable toll on tens, if not hundreds of thousands of people. Of those, the spread of conspiracy theories, or political posturing, will cost us tens of thousands of lives unnecessarily. Many of those will be in the US and that saddens me deeply. Many others will be at risk in already at-risk communities and locations such as refugee camps. So, to close this post out, I’d also like to encourage you all to take some time and join me in donating to a cause working to help those in desperate need of help through organizations such as MSF: https://www.msf.org/donate.

I’d also be remiss if I didn’t explicitly state that it is more important than ever that we follow scientifically driven guidelines and take the mitigation steps required. When I speak to timelines and a relative return to normal, I’m speaking in a context that is based heavily in following mitigation best practices, follows scientific and medical guidance from the experts, and does not seek to rush things. Just as discontinuing your antibiotics on day 4 of 10 because “you feel a bit better” is terrible and socially irresponsible practice. The pre-mature, rushed, incomplete and inconsistent approach currently being put forward by quacks, conspiracy theorists, snake oil salesmen, false patriots and corrupt leaders is the single biggest threat out there to an accelerated, safe, and economically sound recovery.

This means following lockdown procedures. It means keeping things closed as long as they need to be, not as long as some vocal scientifically illiterate group of sock puppets that excessively consumed B.S. on youtube latch onto to justify their own petty preferences. It also means making the difficult decision to keep some borders closed longer than others, in instances where Governments or regional leaders show a lack of scientific literacy or sufficient moral spine to do so. It means that we all have a responsibility to call to question, and invoke a social cost for the type of performance theater tomfoolery which rewards lazy self gratification under the guise of being a “critical thinker”. This includes the sea of nonsense surrounding 5G, attacks on the Gates Foundation, Dr. Fauci, the WHO, vaccination initiatives in general, B.S. virus origin myths, and other related attacks or nonsensical rubbish seeking to undermine health issues.

** All opinions, analysis, and commentary in this post are my own and in no way reflect the views or policies of my employer, nor should they be taken as medical or financial advice.**

Wow, now that was a mouthful. ‘scientifically illiterate group of sock puppets that excessively consumed B.S. on youtube latch onto to justify their own petty preferences’ – that’s hilarious. Totally agree with what you’re saying and where you’re coming from. I saw that Denmark remained more ‘open’, here in Indonesia the situation remains a mystery as there probably never be true numbers of those infected when theres a population of more than 220 million. But as you say, follow scientific data and protocols and if the borders remain closed, suck it up and take a seat! Thanks for sharing Alex